“Companies aren’t stupid, they are just fighting today’s D&O threats with yesterday’s thinking and tools!”

Companies and Directors are smart, capable and experienced. They have great expertise built over many years in running and governing successful companies. They are good at “business as usual” and addressing normal evolutions in their business environment. They are not generally good at “business unusual.”

They have neither the expertise nor the training to address many of the critical “moments that matter” when radical changes and new threats occur in and to their business. Unfortunately, the Directors and Officers (D&O) risk environment is changing radically and continuing to change in very adverse ways. Many of the experiences and learnings from the past in governing and managing companies are not as applicable in today’s D&O world. These historical perspectives and paradigms often drive wrong decisions and actions, with very severe consequences.

What is Next Generation Due Diligence?

Evidence-Based, Experience-Driven Practical Support For Directors and Officers Facing Critical Decisions

Next Generation Due Diligence™ is a research based, structured and systematic decision support methodology incorporating tools and solutions for “Business Unusual”. It is founded on over 25 years of detailed research into successful and unsuccessful operations, strategy and technology transformations, 20 years of effective risk management practices, proven crisis management solutions, and over 1000 successful due diligence assignments. It leverages the best methods and tools successful companies have used to provide practical solutions for non-routine business unusual critical decisions and challenges.

- Due diligence has been with us for hundreds of years. It is heavily based on financial analysis, common sense and the insights of the individuals involved. Where the individuals involved were experienced with the identified challenge and could devote the time needed, the due diligence process generated adequate results.

- Regrettably, due diligence within most companies has become a heavily outsourced and financially oriented process supported by numerous junior analytical resources focused primarily on merger and acquisition decisions. While many due diligence firms add the “tribal knowledge” of the leaders involved and some limited operations assessments to this financial analysis, the lack of rigorous, research validated tools often generates poor insights and inaccurate assumptions upon which decisions are based. Unsurprisingly, research has shown that less than 30% of all traditional due diligence supported acquisitions meet or exceed the projected value of the acquisition 3 years out, and over 33% of all acquisitions generate negative shareholder wealth for the buyer. A coin flip generates better results.

- Further, almost all due diligence efforts on other key “business unusual” decisions (including Directors and Officers risk mitigation, Crisis Management Response and major Operations and Technology transformations) receive ad hoc, non-rigorous and limited focus efforts. In these areas, the results are even worse. Over the last 4 years, D&O lawsuits and settlements have more than tripled, and ineffective crisis responses have severely damaged brands and even bankrupted companies. Similarly, over 70% of all transformations do not achieve their financial goals while costing multiples of their initial budgets.

- In short, traditional due diligence efforts are not providing companies and key decision makers with the insights, information and solutions to make good decisions. Directors and Officers end up relying on “guts and intuition” for all to many critical decisions. Each decision could have major impacts on their companies, their shareholders, and their personal reputations.

There is a better way!

Due Diligence, Inc. has compiled deep research on proven processes and tools and solutions to support many of the “Business Unusual” decisions Directors and Officers face. These solutions and tools are based on:

- Over 35 years of in-depth financial and operational due diligence work for over 400 companies.

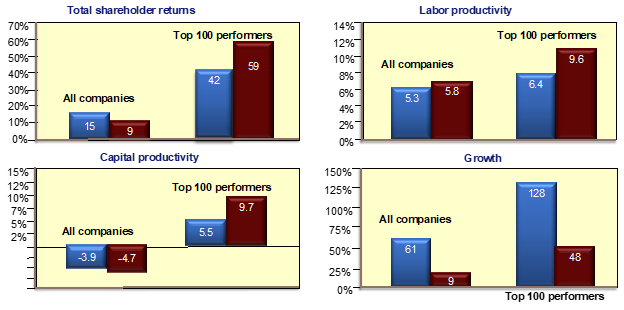

- Over 25 years of research into the risk management and transformation practices of Top Performing US Companies (as measured by growth in shareholder value, capital productivity, labor productivity and revenue growth)

- Over 20 years of research and practical application of successful crisis and risk mitigation and recovery with over 100 clients

- Over 60 successful engagement supporting clients in planning and successful strategy and operations transformations, and recovering troubled technology implementations.

We have integrated this research and client work into integrated, practical solutions and decision models with associated support tools, education and resources. They are designed to help companies and executives with the critical “business unusual” decisions they face.

Each solution utilizes:

- Research Driven Insights and Decision Models

- Proven Application Frameworks

- Data and Analytical Templates

- Assessment Tools

- Structured Training Modules

- Decision Support Architecture

![AI-2-[Converted] AI-2-[Converted]](https://duediligenceinc.com/wp-content/uploads/elementor/thumbs/AI-2-Converted-qls6ouphdwxep4xgrvwniv770c3qod5mp88ui4ew44.png)